It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

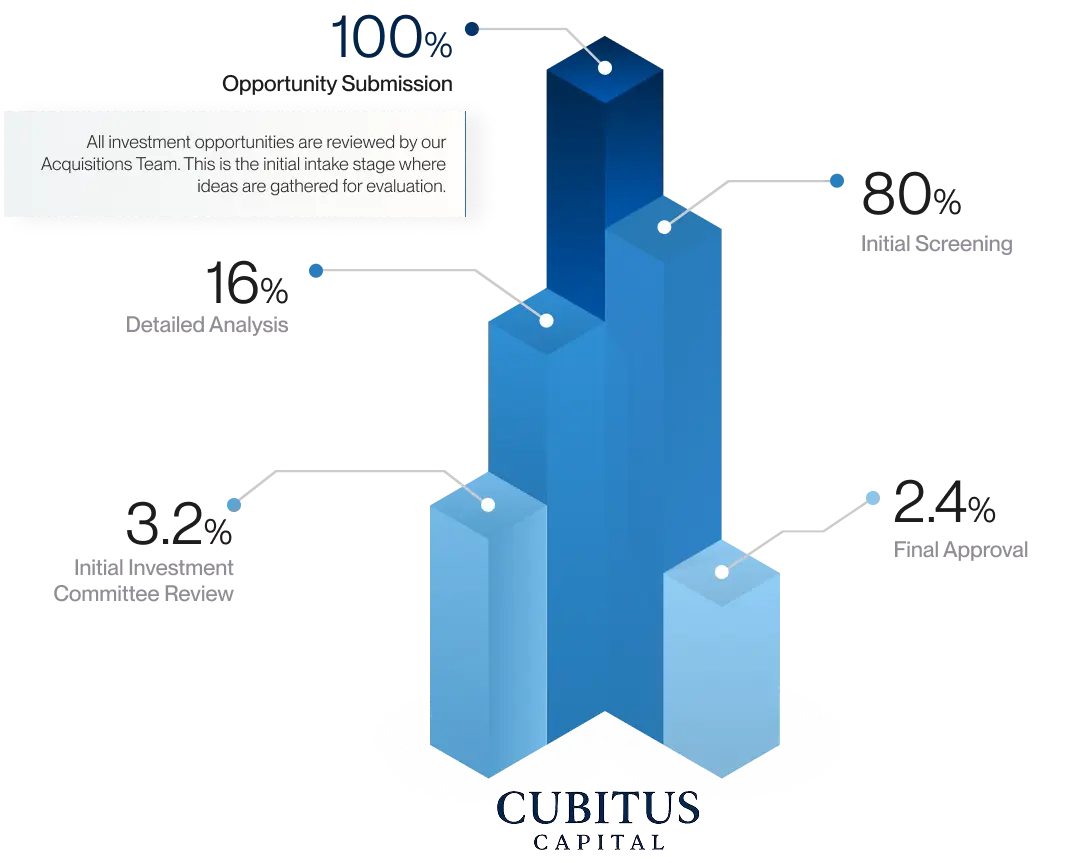

Typically less than 3% of the investment opportunities pass through

Focused on multi-family properties (value-add, core-plus), student housing, single-family rentals (SFR), and built-to-rent (BTR) communities.

Developer Experience: Preference for seasoned developers with 3+ successfully completed projects in strong local markets, demonstrating a proven track record.

Hold Period: Ideal investment horizon of 3–7 years, with flexibility for optimal exit strategies.

Target Returns: Transaction-specific, with a focus on maximizing value while balancing risk.

Cash-on-Cash Profile: Emphasis on healthy going-in cash-on-cash returns to ensure steady income generation.

Preferred Markets: U.S. markets with strong fundamentals, robust demand, and diversified employment or economic drivers.

Current conditions in the multifamily market—characterized by reduced proceeds from senior lenders and a more cautious stance from equity investors—have opened up significant opportunities for preferred equity and mezzanine financing. Cubitus Capital's Solution Capital® platform is designed to bridge the "gap" in capital structures, offering tailored financing solutions to sponsors.

Solution Capital® provides funding for:

Refinancing existing assets

Recapitalization efforts

Cap rate-driven acquisitions

Other unique or transitional scenarios

Units

Asset Class

State